The ideology that saving the planet will maximise profits is dying. The sustainable investing movement is letting go of ideological purity and embracing a more pragmatic view. Every investment involves trade-offs, and with forestry there is no exception.

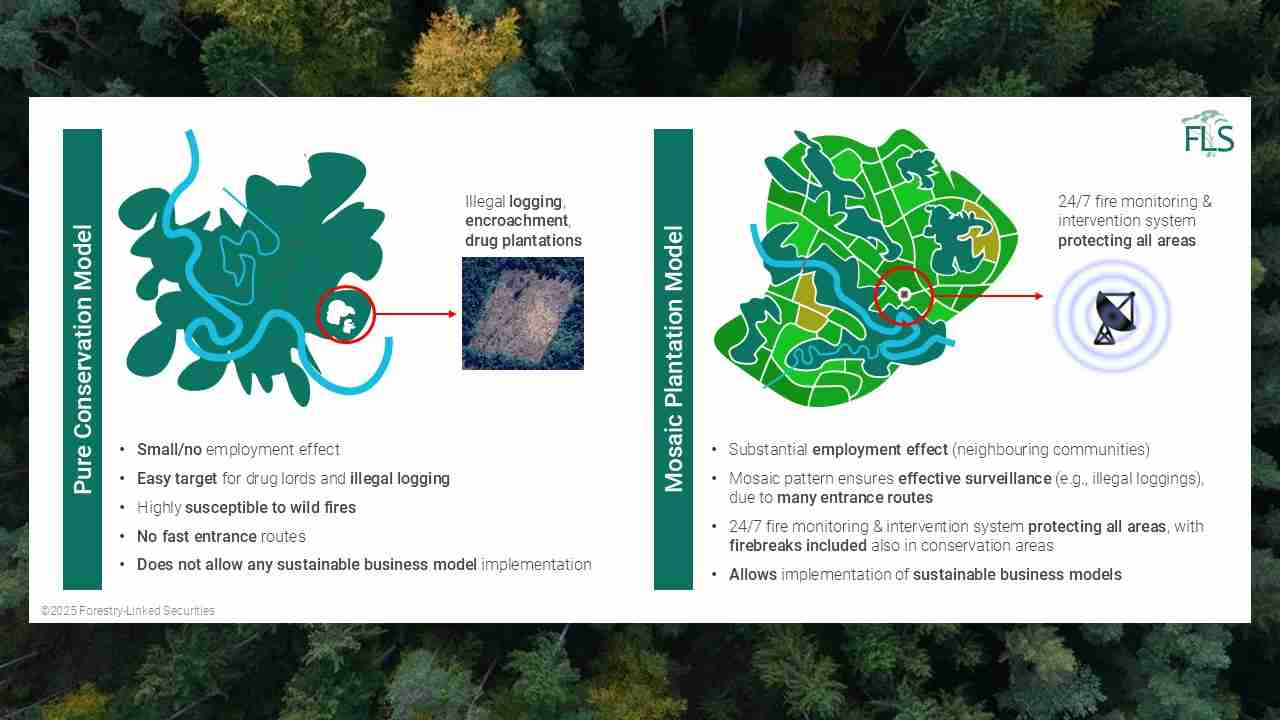

The next chapter in forestry is about navigating these choices by balancing financial returns with carbon sequestration, biodiversity and social impact. By doing so, we can create a truly sustainable long-term investment. Combining commercial forestry with conservation efforts can create valuable operational synergies, which protect natural forests from threats like wildfires and illegal logging. The commercial part enables firebreaks, establishes sophisticated monitoring protocols and instils regular intervention, while also delivering long-lasting social benefits, such as job creation and cyclical replanting of harvested wood. At a time when staying below 1.5 degrees looks increasingly unattainable, and there is a supply deficit of wood requiring up to $4.5tn by 2050, there would seem the makings of a perfect trade-off.

Learn more here