This report highlights Liontrust’s 22 sustainable investment themes including those that will be key in driving forward the changes needed for the world…Sustainable Investment Annual Review 2023 – Liontrust

Funding for companies seeking to transform society and the environment has fallen. Discover the reasons and what private equity investors could do about…Meeting the capital challenge within impact growth equity – M&G Investments

Imagine driving sustainable growth, unlocking untapped economic potential, and making a profound societal impact, all through equitable access to finance…Invest in equality: the power of gender-inclusive finance – Finance in Motion

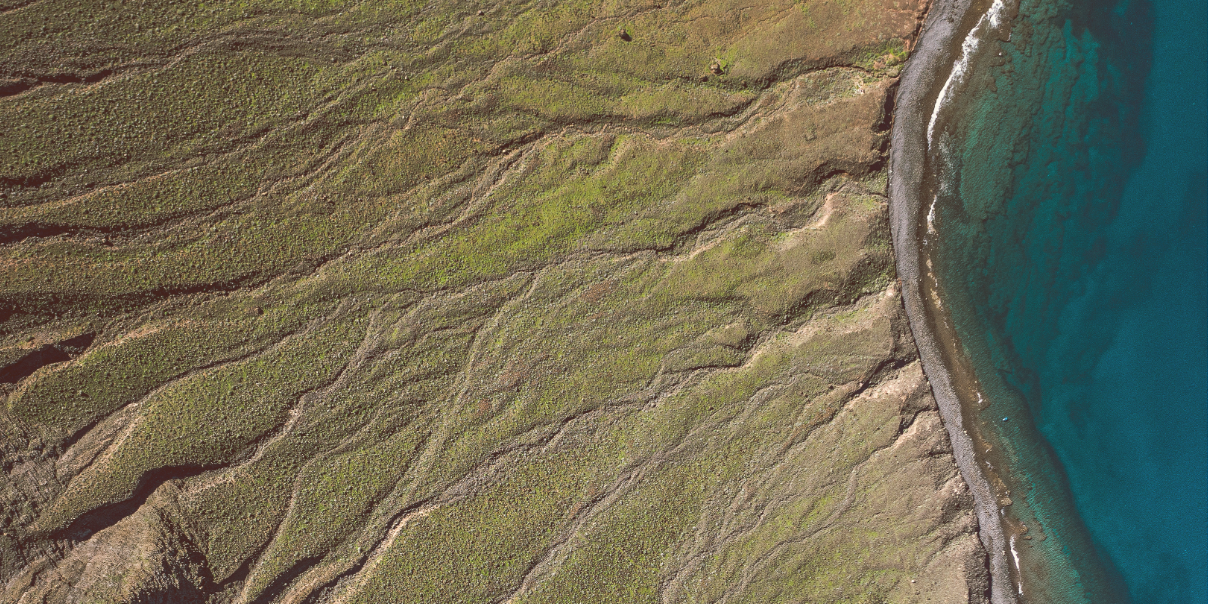

Charlotte Moore, Richard Giles and Robert Gardner discuss the importance of making nature an investable asset.Biodiversity and nature - P4P Podcast - S1 Ep2

All-member online Community event.16 July 2024 – How do asset owners address systemic risk?

Separating the green from greenwash.ESG Viewpoint: nature positive commitments – Columbia Threadneedle Investments

An exclusive hybrid event at 10:30-14:00 BST with the Pensions Equity Group (PEG) and Independent Governance Group (IGG).15 July 2024 – By invitation only - Generation rent

Markets depend on a stable and functioning society to operate effectively. Inequality poses a systemic risk to the economy, how will the new taskforce…Introducing the Taskforce on Inequality and Social-related Financial Disclosures – Constance Johnson

Will Americans return to the office? It may depend on where it is and what it offers.Office space: looking past the doom and gloom – AllianceBernstein

Institutional investors have the opportunity to invest in emerging technologies which can help accelerate our journey to net zero, whilst having the potential…Why LGPS funds should embrace sustainable infrastructure – Octopus