With a 4.3mn shortage of homes in the UK, there is an ever-growing need to repurpose redundant buildings and regenerate brownfield land.A catalyst for real estate transformation – video – Octopus

Active management can help investors address some of the especially tricky issues in sustainable equity investing.Active or passive? Seeking solutions to ESG confusion – AllianceBernstein

In the second segment of their energy transition mini-series, Hymans Robertson delve deeper into investment opportunities and addresses common inquiries…Focus on change: investment opportunities in the energy transition – Hymans Robertson

Civitas wins property investor of the year, 2024!Winner: Property Investor of the Year, HealthInvestor Awards – Civitas Investment Management

FSSA Investment Managers seek to invest in quality companies and hold them for the long term.ESG Report 2023: highlighting their ESG activities and company engagements – FSSA Investment Managers

ESG Investor, July 2024Large managers can move needle on impact - Karen Shackleton comments

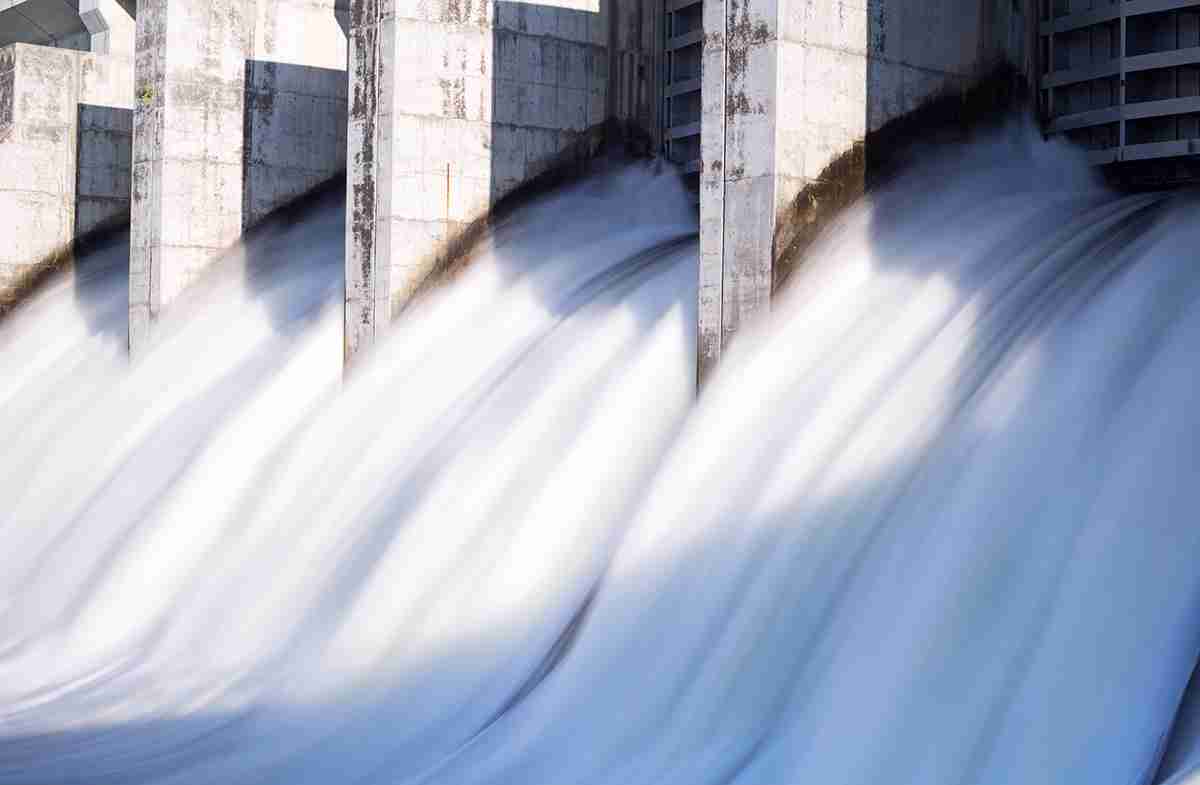

Water risks: how to build water-conscious investment strategies?Mastering the flow of water risks – Candriam

Social infrastructure is a fast-growing sub-sector of the asset class, fuelled by the indebtedness of the public sector. Christopher Walker (IPE Real Assets)…Social infrastructure: the new kid on the block, IPE Real Assets – Civitas Investment Management

Mhairi Gooch provides insightful analysis on these themes in Hymans Robertson's latest article, inviting readers to contemplate the intersection of food…Focus on change: food systems – Hymans Robertson

Newton Investment Management set out their approach to stewardship and how they strive to meet the UK Stewardship Code’s principle.Sustainability and stewardship 2023 annual report – Newton Investment Management