In-person masterclass with cio investment club in London.21 October 2025 – Insurers for Purpose: Insurance companies’ sustainability and investment ambitions

The concept of 'financially material' risks, and whether you can take actions to deal with them, has never been more relevant.Creakonomics: all it would take is a push – part II – LCP

Water scarcity, supply-chain risk and board-level decisions underscore the importance of a stewardship lens.How a stewardship lens may help sort corporate leaders from laggards – AllianceBernstein

No strategy for long-term resilience is complete without considering the ocean.The economics of the ocean: risks and opportunities for investors – Osmosis Investment Management

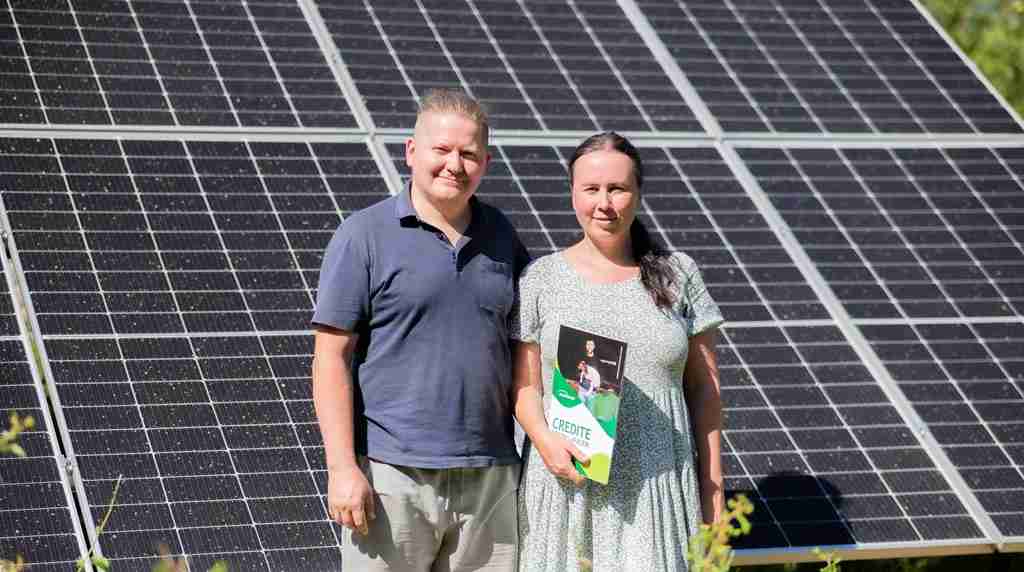

In Moldova, small loans make the difference between hope and leaving.How Microinvest is changing the lives of 42,000 Moldovans – Triodos Investment Management

Cast your mind back to 2011. The Eurozone was engulfed in a sovereign debt crisis, with Greece at its core, teetering on the brink of default.Creakonomics: why you should care about systemic risks - part I – LCP

Our Director, Laasya Shekaran spoke at the 2025 TWIN Conference on 16 October 2025.16 October 2025 – TWIN (The Women’s Insurance Network) Conference 2025

Europe is facing a demographic shift as the baby boomer generation enters retirement, and its ageing population continues to grow.The baby boomer opportunity: why senior housing should be a priority for Europe – Octopus Capital

By Sylvia Wisniwski, CEO of Finance in Motion.The apocalypse of agriculture: a cautionary tale – Finance in Motion

Laasya Shekaran welcomes Tatiana E von Petersdorff and Matt Foley of EY, to the Podcast to discuss sustainability and impact in insurance, and why it matters…Sustainability in pensions insurance – P4P Podcast – S2 Ep15