Spinning the decks on ESG.Hot topics in pensions: Autumn 2021 - Squire Patton Boggs

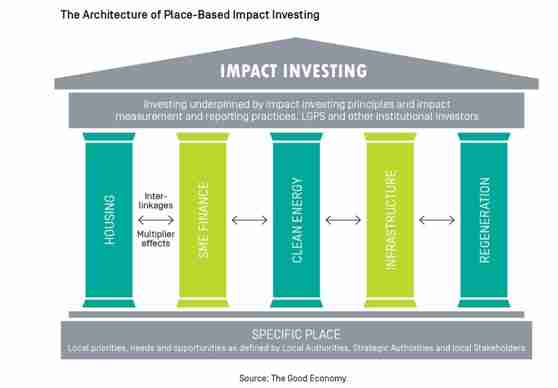

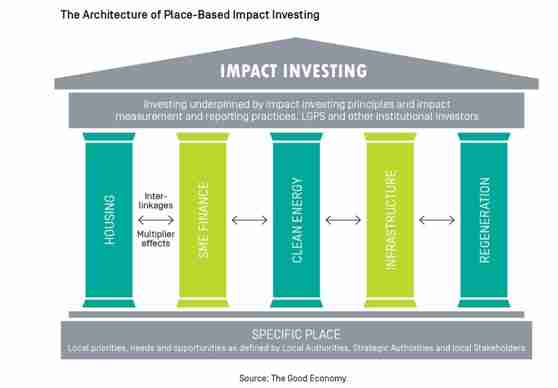

At this asset-owner only discussion, Karen Shackleton (Chair and Founder, Pensions for Purpose) was joined by Debbie Fielder (Clwyd Pension Fund) to discuss…20 October 2021 - Investing in place: an asset owner discussion - Impact Investing Institute and Pensions for Purpose

At this investment consultant only discussion, Charlotte O'Leary (CEO, Pensions for Purpose), following an introduction by the Impact Investing Institute,…19 October 2021 - Investing in place: an investment consultant discussion - Impact Investing Institute and Pensions for Purpose

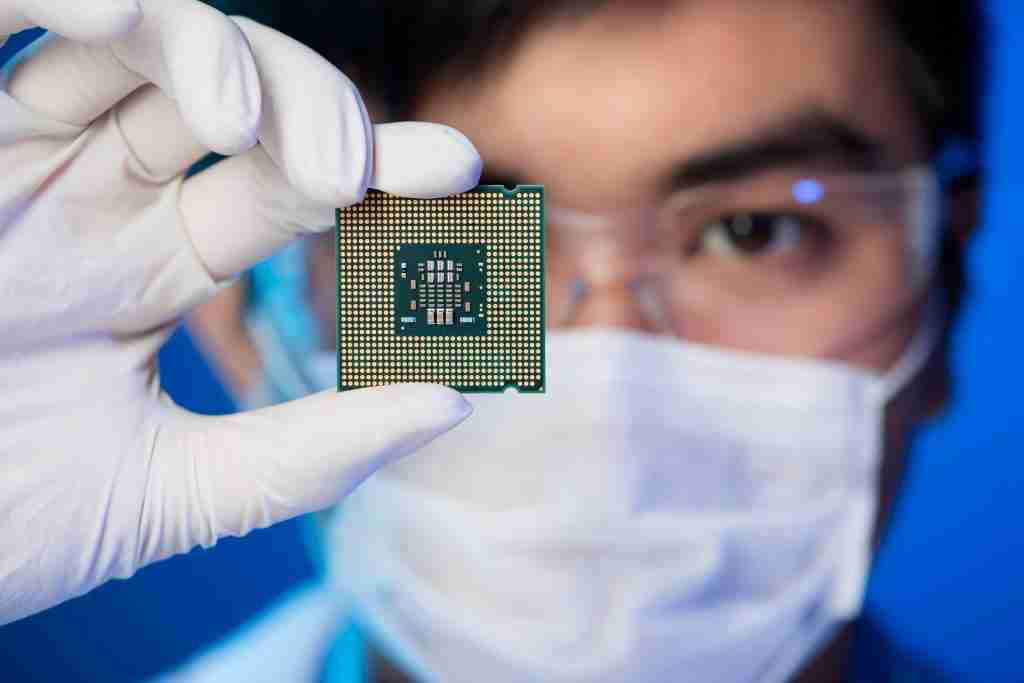

If you've been in a queue for petrol or gone to the shop for something as benign as tinned tomatoes only to see the shelves empty, you don’t need to told…We’ve been warned – climate crisis and weak links in the supply chain - WHEB, part of Foresight Group

Welcome to Spectrum – a sustainability focused newsletter that brings together insights from across Federated Hermes' investment floor, including their…Financial inclusion: an economic opportunity for all - Federated Hermes

Pension trustees are subject to legal requirements when setting their investment policy and choosing investments and this includes a requirement to take…Pensions quick guide: environmental, social and governance (ESG) - Squire Patton Boggs

COVID-19 has resulted in a paradigm shift: it has thrown into sharp focus the need for resilient healthcare systems and supply chains, while also highlighting…Impact Annual Report, 2020 - Federated Hermes

New governance and reporting requirements in relation to climate-related risks and opportunities for larger pension schemes and authorised master trusts.Climate change guide - How2DoPensions: publication of TCFD reports - Squire Patton Boggs

Companies that integrate ESG goals with executive pay incentives are more likely to deliver on their responsibility pledges to stakeholders.Encouraging effective executive pay structures - AllianceBernstein

This note outlines what the ITR is, how it differs from backward-looking metrics and how it can construct a core, diversified global equity portfolio aligned…Using Implied Temperature Rise (ITR) metrics in a climate-aligned global equity portfolio – Fulcrum Asset Management