The Green Finance Initiative published a case study featuring Lyme's approach to mitigation banking.Green Finance Initiative – The Lyme Timber Company case study: mitigation banking

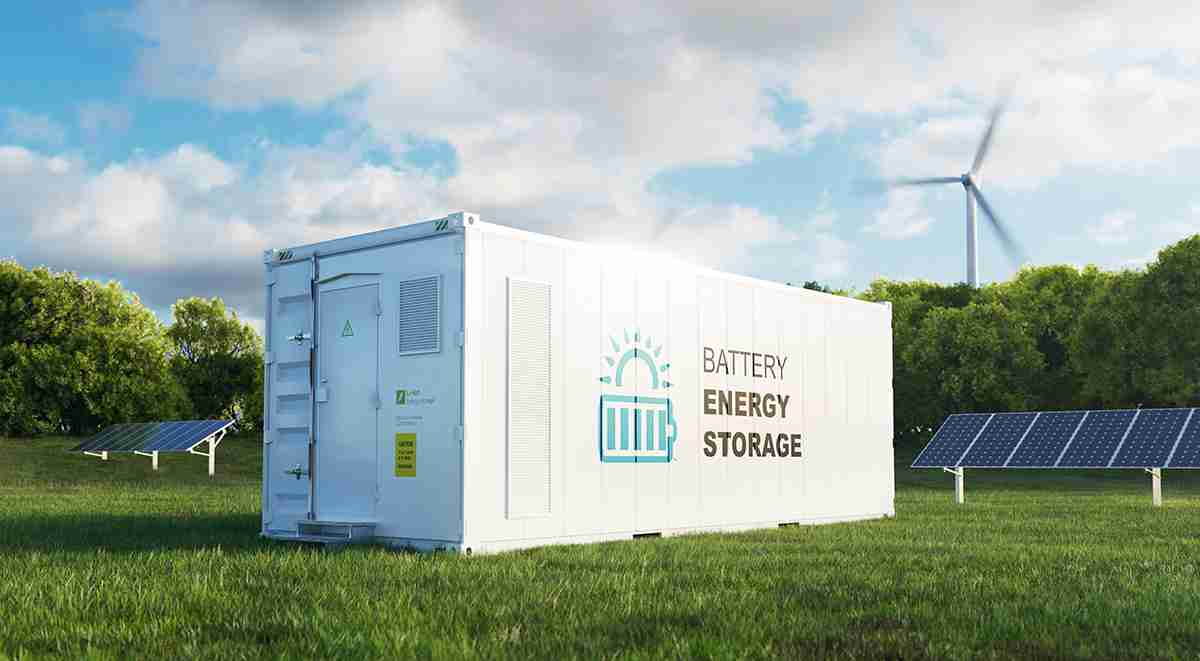

Big batteries are perhaps the key to making a completely renewably powered grid possible.Massive storage. This is how to power the grid with 100% renewable energy! – video – Harmony Energy

A system-led approach to investing, helping investors address broader environmental and social issues beyond climate alone.Testing the boundaries of environmental, social and governance – Barnett Waddingham

aberdeen Investments consider why government bonds could be the missing link for decarbonising investment portfolios.Government bonds: the missing link in decarbonising portfolios? – Aberdeen Investments

Companies face risks related to water withdrawal, consumption and discharge.An unquenchable thirst – Federated Hermes Limited

Investors have access to plentiful information – and a gauntlet of conflicting views. Gaining clarity on pivotal forces shaping the world, from geopolitics…Rethinking adversity to seize opportunity – Lombard Odier Investment Managers

Looking for a new symbiosis with nature.Biodiversity: ready to take up the challenge of biodiversity integration? – Candriam

WHEB, part of Foresight Group have heard a lot about the ‘Trump Trade’ in the aftermath of the US election. This describes the huge stock market gains…What a Trump presidency means for sustainable investors – WHEB, part of Foresight Group

The Green Finance Institute published a case study on Lyme's history of conserving forests.Green Finance Institute – The Lyme Timber Company case study: conservation easements

The UK’s battery storage industry has grown rapidly, but more must be done for the technology to make a vital contribution to net-zero targets, writes…Leading the charge: the crucial role of battery energy storage on the road to net zero – Harmony Energy