It seems like a good time to take stock of sustainability regulation.SI Dilemmas: is EU Sustainable Finance Regulation helping or hurting? – Robeco

The world’s goal of eradicating extreme poverty by 2030 now looks unlikely to be met.Global extreme poverty: shocks and setbacks – Jupiter Asset Management

For many years, the debate has raged among investors and academics about whether sustainable investors need to sacrifice returns in order to achieve their…SI Dilemmas: we need to start thinking differently about SI and returns – Robeco

With growing investor and regulatory pressure, will there be an increase in allocation to impact investments?Is impact investing the next frontier of sustainable investments? – Connected Asset Management

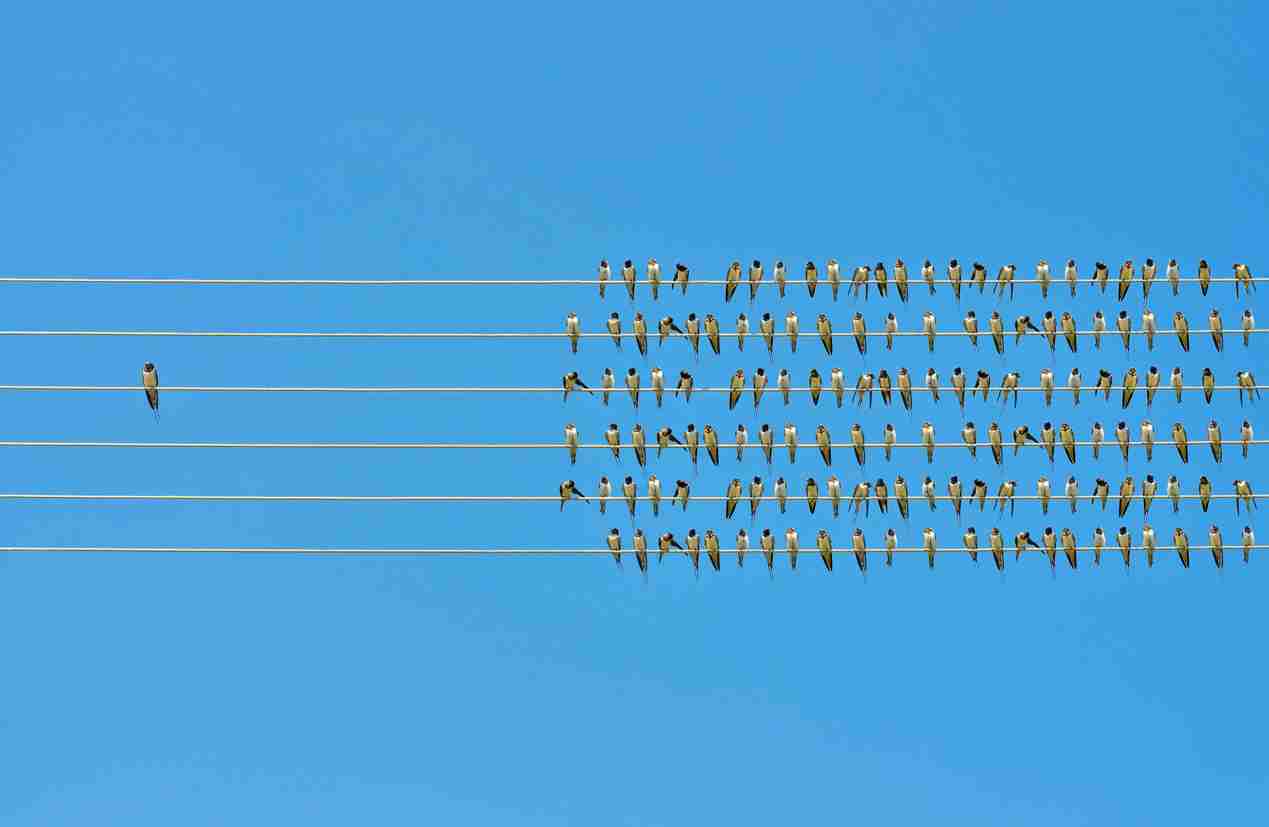

In August, Robeco announced they are sharing their sustainable investing intellectual property, starting with their SDG framework.SI Dilemmas: to share or not to share IP – that is the question – Robeco

Say-on-climate votes are becoming more popular and a common framework is needed, Paula Meissirel, stewardship analyst at BNP Paribas Asset Management,…Say-on-climate votes must move beyond box ticking – BNP Paribas Asset Management

Environmental solutions are crossing a watershed.Outlook 2023 – Jupiter Asset Management

The COP27 climate summit delivered a few wins but was disappointing overall.SI Dilemmas: keeping on course for net zero by 2050 – Robeco

Protecting biodiversity has become as important as tackling climate change.Five things you need to know about biodiversity investing – Robeco

The value of strong corporate stewardship is gaining wider recognition across the investment industry.Investing in ESG leaders with a stewardship lens – Wellington Management