ESG Investor, July 2024Large managers can move needle on impact - Karen Shackleton comments

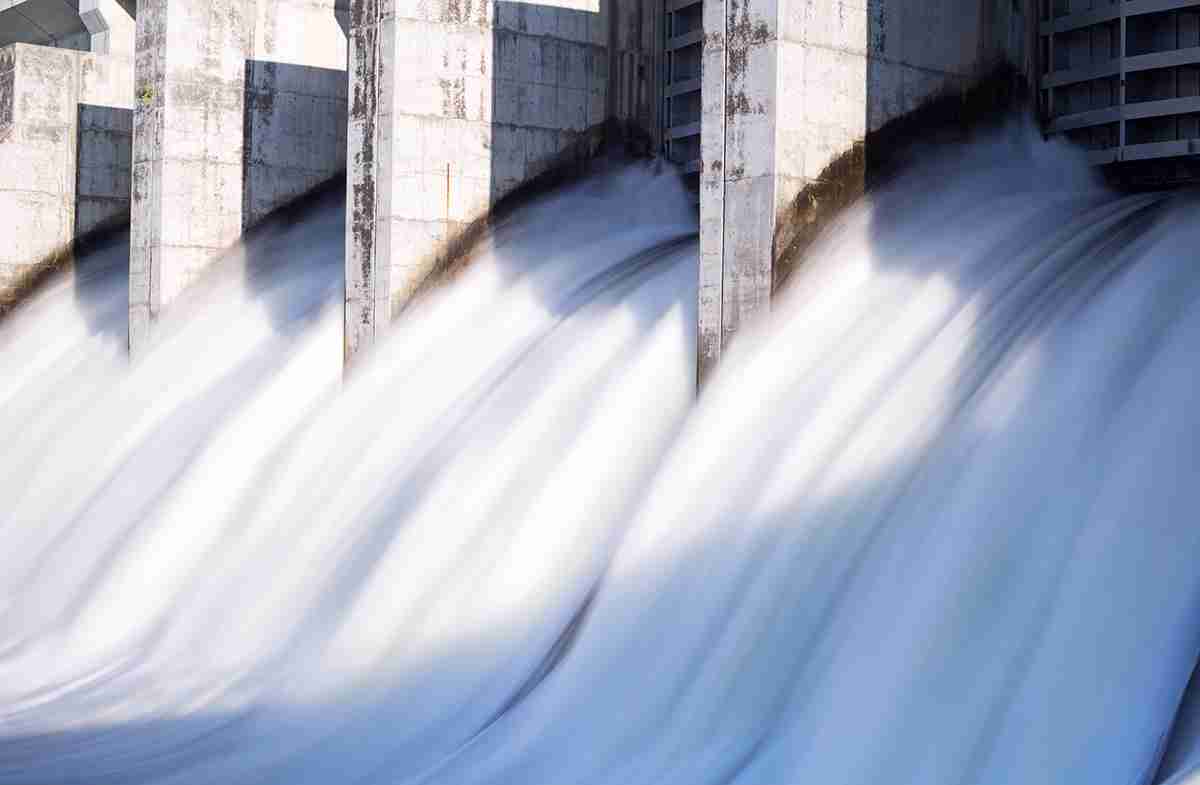

Water risks: how to build water-conscious investment strategies?Mastering the flow of water risks – Candriam

Social infrastructure is a fast-growing sub-sector of the asset class, fuelled by the indebtedness of the public sector. Christopher Walker (IPE Real Assets)…Social infrastructure: the new kid on the block, IPE Real Assets – Civitas Investment Management

Mhairi Gooch provides insightful analysis on these themes in Hymans Robertson's latest article, inviting readers to contemplate the intersection of food…Focus on change: food systems – Hymans Robertson

Newton Investment Management set out their approach to stewardship and how they strive to meet the UK Stewardship Code’s principle.Sustainability and stewardship 2023 annual report – Newton Investment Management

This report highlights Liontrust’s 22 sustainable investment themes including those that will be key in driving forward the changes needed for the world…Sustainable Investment Annual Review 2023 – Liontrust

Funding for companies seeking to transform society and the environment has fallen. Discover the reasons and what private equity investors could do about…Meeting the capital challenge within impact growth equity – M&G Investments

Imagine driving sustainable growth, unlocking untapped economic potential, and making a profound societal impact, all through equitable access to finance…Invest in equality: the power of gender-inclusive finance – Finance in Motion

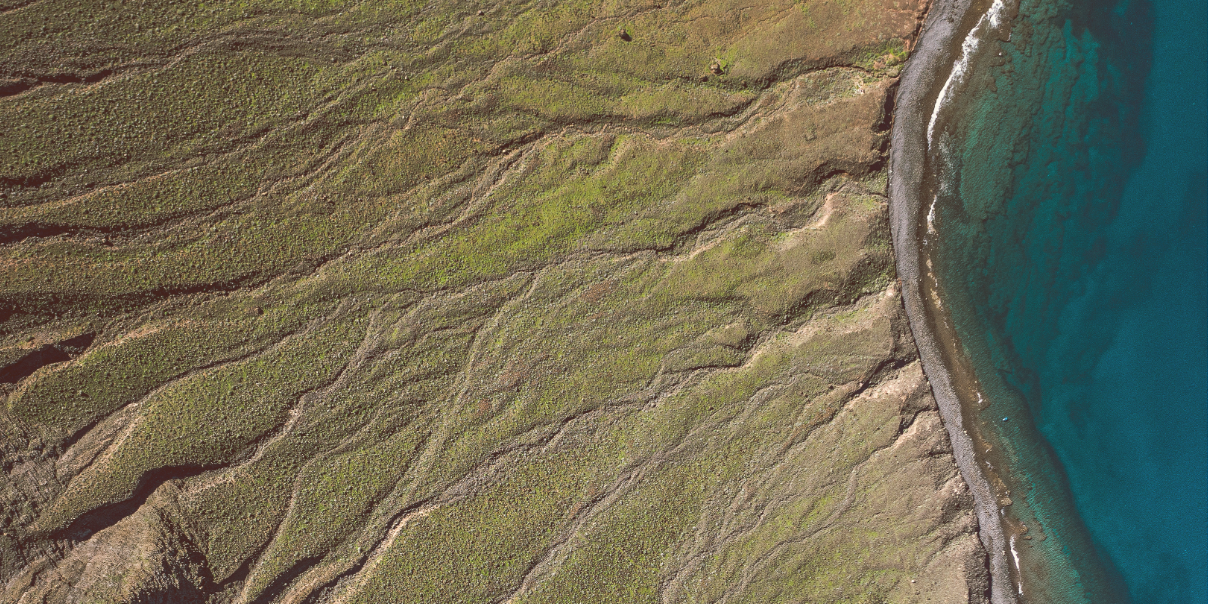

Charlotte Moore, Richard Giles and Robert Gardner discuss the importance of making nature an investable asset.Biodiversity and nature - P4P Podcast - S1 Ep2

All-member online Community event.16 July 2024 – How do asset owners address systemic risk?