Mass extinction: the impact on business and society.Biodiversity loss – Montanaro Asset Management

Delivering legislation, regulation and standards that foster sustainable and a more equitable development is central to tackling sustainability issues,…Investor engagement to tackle corporate lobbying is critical to addressing diet-related diseases – BNP Paribas Asset Management

Can pension funds deliver on their net-zero targets and what can best practice look like? A review of LGPS investment strategy and solutions from across…21 June 2023 – Global Impact Forum asset owner event with Tikehau Capital and Jill Davys, Head of LGPS at Redington

Hear about their innovative strategies for working together to impact Cornwall.7 June 2023 - Place-Based Impact Investing Forum online all-stakeholder event with Brunel Pension Partnership and Cornwall Pension Fund

Read our A-Z definitions to stay up to date with impact investment terminology.G for Green bonds – A-Z of impact investing

Can LGPS capital be a force for good in the UK?Levelling up – AlphaReal

BMW has set targets for its electric vehicles strategy and addressed climate lobbying concerns.Engagement case study: BMW – Federated Hermes Limited

With sea levels continuing to rise, coastal flooding is already a considerable – and growing – economic threat to low-lying regions, says BNP Paribas Asset…Rising tides – the impact of coastal flooding on sovereign credit risk – BNP Paribas Asset Management

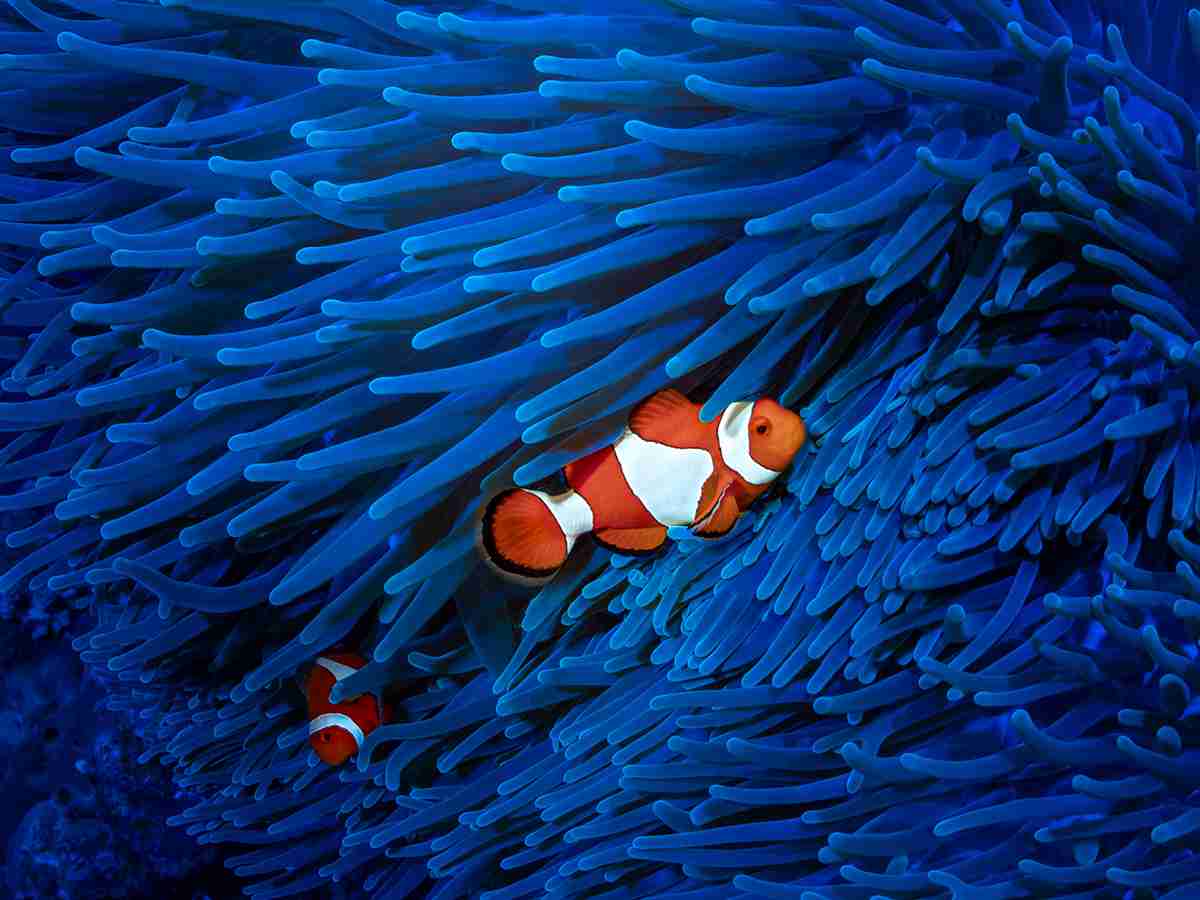

Managing risks, having a positive impact and meeting regulations are three reasons why fixed income investors should consider biodiversity within their…Why, and how, investors should integrate biodiversity into fixed income portfolios – AXA Investment Managers

Discover how value investing strategies can provide fertile ground for investors to build effective ESG portfolios, without the need for blanket exclusions.Value investing and ESG: every sector matters – J.P. Morgan Asset Management